Do you use a Reward Card and are you aware of what that entails?

This may seem like a small thing, considering the issues facing our world right now, but so often it’s the little things in our daily lives which can have the greatest impact. Let us not pretend we make any difference by voting for interchangeable political parties; we make a difference in this modern world by voting with our feet and with our wallets.

This is why I’d like to highlight something which most people barely give a second thought to, but I consider to be a big player in our ongoing battle for privacy and freedom. If you can’t imagine how a Reward Card can possibly have anything to do with these things, I implore you to read ahead and consider what I have to say.

Stores like Tesco and Sainsbury’s, to name just 2, are making ever more of their products available at a nice discount, as long as you sign up for and use their loyalty card. By using them, you ‘earn’ points which can be used as currency, whilst also getting access to deals on items. Sounds great, right?

Free Stuff!

If you think you’re getting all of this for free, bless your gentle soul. There was perhaps a time when the sole purpose of loyalty cards was exactly that - to ‘reward’ your loyalty for repeatedly shopping at the store in question, resulting in a fairly mutually beneficial arrangement. I believe this has dramatically changed, and the valuable commodity the store is after is not merely your loyalty, it’s your data.

Essential Items & Lack of Choice

Almost every company now operates some kind of loyalty scheme and, while most will claim to never sell your data, it somehow always ends up for sale anyway. And even when your data isn’t being sold, it’s being ‘shared’ with a wide range of partners, suppliers, and other companies.

I’m focusing on loyalty schemes from supermarkets, particularly Sainsbury’s Nectar Card and Tesco’s Clubcard, because I believe these are by far the worst offenders. Due to the simple fact these businesses sell ‘essential items’ such as food, drink, and hygiene products. In other words, you have no choice but to buy these items from somewhere, and these guys are two of the biggest (in the UK).

We seem to be savvier these days to the products on perpetual sale, those items which are on sale so often we know the sale price is actually the real price, but I’m now seeing more of these items available on the loyalty scheme instead. It’s a subtle change, but one which helps to hide the real price, whilst dramatically increasing the cost for every non-loyalty scheme member.

I recently visited a Tesco in London where every single item was on the Clubcard loyalty scheme, with around 50% ‘discounts’ on everything. I also live near 3 major supermarkets (Tesco, Sainsbury’s, and Aldi) and I can easily compare prices across the stores. It’s obvious the prices are being artificially inflated in order to offer a discount on the scheme. Something which isn’t always illegal, but always unethical.

With these practices applied to food and other essential items, I believe they are essentially forcing customers to sign up to their schemes. This is particularly relevant as inflation and the cost of living continues to increase, and people can afford less and less. These companies are effectively giving people the ‘choice’ of paying 50% more for their food, or providing widespread access to their personal data.

Am I Actually Saving Anything?

The irony goes beyond the fact consumers aren’t really ‘saving’ anything on their shopping with all the fake discounts, because they’re actually spending more than ever. Companies use all of your data to target you with personalised and specific marketing, designed to get you to spend as much as possible. It works too, with loyalty scheme members spending up to 20% more and up to 20% more frequently than non-members.

What Data Are They Collecting?

Let’s take a look at a single example. Nectar (Sainsbury’s) boasts having over 300 big brand partners and collecting the shopping and personal data of over 18 million people. This company collects the following information (emphasis mine)

“…personal data such as your name, home address, email, and telephone number”

“…details about the transaction such as what you purchased and where you purchased it… transactions and transaction history related to the payment card you signed up with”

“IP addresses, MAC addresses, unique IDs such as advertising IDs, location data, information about your browser, or details contained in URLs used in our communications with you”

“…personal data that we receive or use provided by companies that provide customer information… verify or update your address, or companies that provide us with information on your modelled household profile”

They also anonymise data, so they can build huge data models and avoid any pesky rules surrounding the use of it - “…because we can’t identify people within anonymous data, it is treated differently from personal data and is not covered by this policy”.

They share your information with pretty much everyone - their 300+ partners, brands, suppliers, service providers, even a vaguely named ‘other organisations’. They also share your data with Sainsbury’s Bank, Argos, Habitat, and Tu, so they can create data models indicating your ‘credit worthiness’ and ‘insurance risk’.

When you signed up, did you know your transaction history would be used to assess your financial capabilities?

Why Do I Care if They Have My Data?

With our data being collected and combined to create our online profiles by companies around the world, how exactly might they be used? Here are a few potential consequences you may not have considered.

Increases the likelihood and severity of Identity Theft, as your online profile becomes cheaply available for anyone to use

Buying alcohol and cigarettes? Your health insurance premiums could go up

Supporting a certain political party? Let’s hope future employers are in agreement

Buying too many takeaways? Frivolous spending could scare away lenders and banks

Models are even used to make predictions about you and your behaviour - whether you’ll quit your job, become pregnant, commit a crime, or even when you’re likely to die

These companies know you better than you know yourself, and they use this information to manipulate your thoughts and actions. Do you think they are benevolent and work to your benefit or to theirs? Just how much do you trust them?

Social Credit Scores

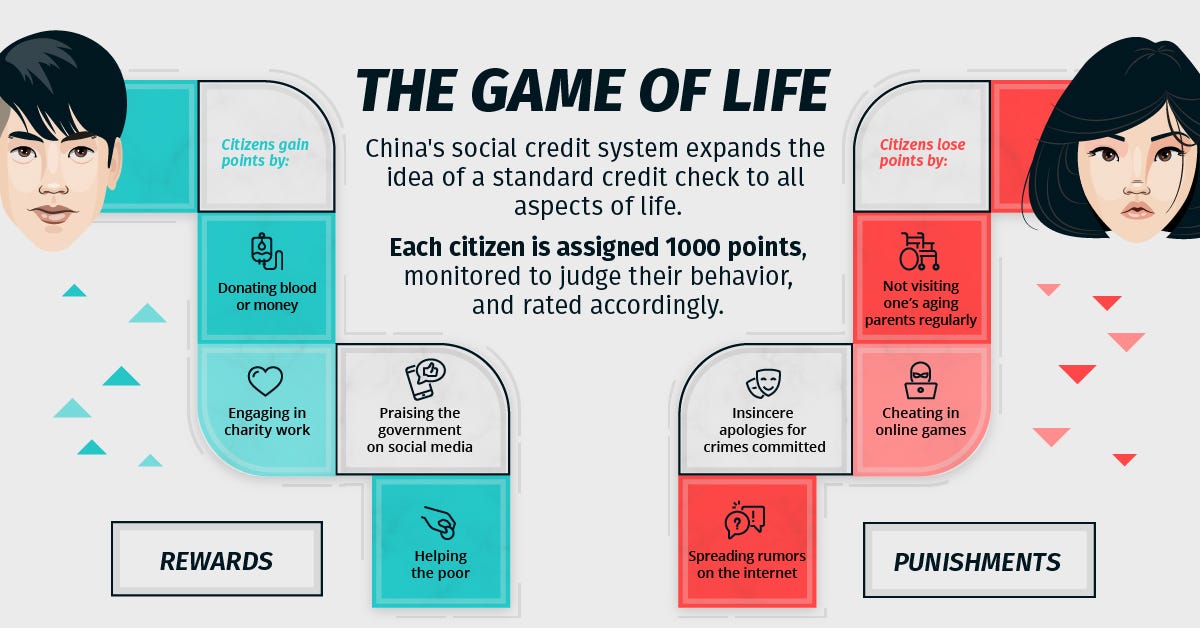

It doesn’t take a huge leap of imagination to consider this type of data profiling being used by governments instead of corporations; certainly not when we are seeing this already gathering pace in countries like China. We have Credit Scores in the UK and it would be simple thing to match these to our online profiles. In a few short steps, we could have digital profiles detailing everything including our spending habits, desires, dreams & aspirations, even our thoughts on the current government… All in the hands of those who govern us.

We’re watching China use AI and facial recognition to track and profile an entire minority group with the Uyghurs. Do we trust our own government to use this sort of data to our benefit? Combine this with Central Bank Digital Currencies (CBDCs) wherein the government, through central banks, have total control over how you access and spend your money. You don’t need to be a conspiracy theorist to see the potential problems here; this all sounds rather dystopian because it is.

A low credit score could result in you being banned from traveling, accessing certain shops or restaurants, your children may be denied access to higher education, your pets could be confiscated, you may be refused credit or mortgages, the list goes on. With these potential punishments on the line, it’s no wonder 66% of survey respondents said a Social Credit Score would change their behaviour. This means the credit supplier, aka the government, would have a greater ability than ever to influence and control public behaviour.

With the frequent construction of massive new data centres, we can see clearly the high profitability of data collection and an ongoing investment in the future of Big Data. This isn’t going anywhere and it’s time everyone realised what we’re doing, and what we’re contributing to, the next time we scan that loyalty card for an artificial discount on an item we probably didn’t even want in the first place.

Practical Advice

Some proactive suggestions

Shop at stores without Loyalty Schemes

Buy items from elsewhere if they’re on a Loyalty Scheme

Complain to managers in-store and online

Raise awareness of the issue with friends, family, and the public

Contact your local MP to raise Privacy and Cost-of-Living concerns

Great article - thanks.